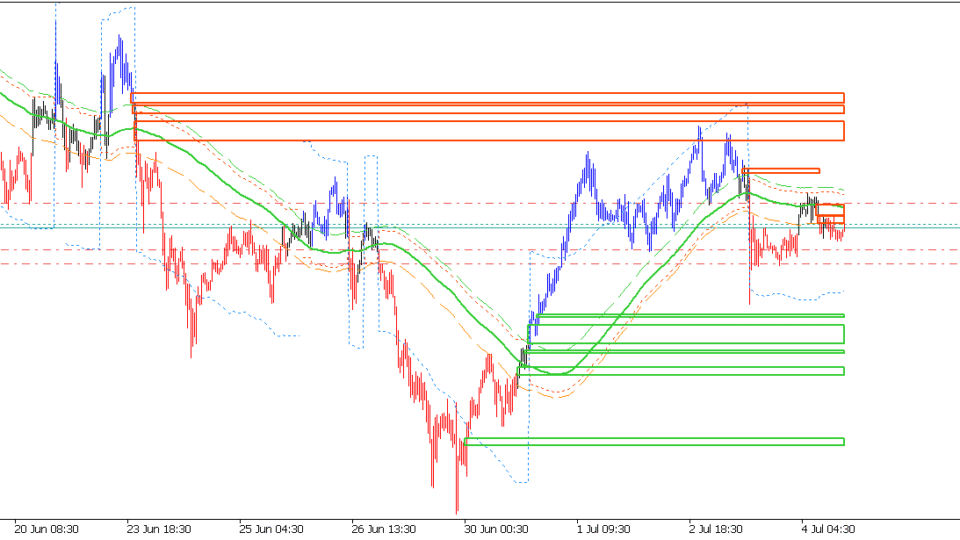

Gold at a Critical Liquidity Turning Point: Will Sellers Maintain Control or Will Buyers Trigger a Reversal? | XAUUSD M30 Analysis July 2025

The current XAUUSD 30-minute chart shows gold trading at $3334.86, consolidating just beneath a prominent sell-side liquidity cluster. This setup aligns perfectly with the Takeover & Relinquish & Exhaustion Indicator Strategy, highlighting clear zones of supply and demand.

The current XAUUSD 30-minute chart shows gold trading at $3334.86, consolidating just beneath a prominent sell-side liquidity cluster. This setup aligns perfectly with the Takeover & Relinquish & Exhaustion Indicator Strategy, highlighting clear zones of supply and demand.

Key Technical Levels:

- Relinquish (Sell) Zones:

- 00 – 3355.00: This red rectangle zone has consistently absorbed buying attempts, signalling strong supply and exhaustion of bullish momentum. Price repeatedly failed to sustain above this area, confirming active seller presence.

- 00 – 3375.00: If gold breaks above the first resistance, this upper band represents a secondary, high-impact sell zone where sellers are expected to reassert control.

- Takeover (Buy) Zones:

- 00 – 3310.00: Marked by green rectangles, this is the first significant demand area where buyers have previously intervened, making it a logical spot for a potential rebound.

- 00 – 3272.00: A deeper liquidity pocket, historically supporting strong buyer accumulation and offering a high-probability reversal area if the downtrend extends.

Exhaustion Indicators:

- Price action shows clear signs of exhaustion at the lower edge of the red zone, as repeated attempts to break higher have failed.

- The green rectangles below the current price highlight areas where downward momentum may stall and buyers could regain strength.

Scenario Outlook:

- As long as gold remains below 3355, the bias favours sellers, with targets at 3320 and, if broken, 3295.

- A decisive breakout above 3355 could trigger a move towards 3365–3375, where new relinquish signals are likely to emerge.

- A break below 3310 would confirm bearish dominance, targeting the 3295–3272 takeover zone for possible accumulation.

Risk Management:

- For active sell scenarios, stop-loss should be placed above 3361.

- For buy scenarios from 3295–3272, stops should be set below 3265.

This analysis is strictly based on the Takeover & Relinquish & Exhaustion Indicator Strategy, focusing on liquidity dynamics and exhaustion signals, not random price action.

#DrHishamTR #TakeoverRelinquish #GoldAnalysis #XAUUSD #LiquidityZones

Stay updated with our latest insights and signals:

Official website: https://drhishamyounistakeoverrelinquish.com

WhatsApp: https://wa.me/+201019974354

Follow us on X: https://x.com/hisham_m_younes

Open a funded trading account (minimum $2,000): https://t.ly/HYCM/SignUp

Live trading sessions and exclusive indicators are reserved for large account holders only.

#DrHishamTR #TakeoverRelinquish #GoldAnalysis #XAUUSD #LiquidityZones

Leave a Reply